2018 Shared Responsibility Payment Worksheet

Ad The most comprehensive library of free printable worksheets digital games for kids. Where will the shared responsibility payment be reported.

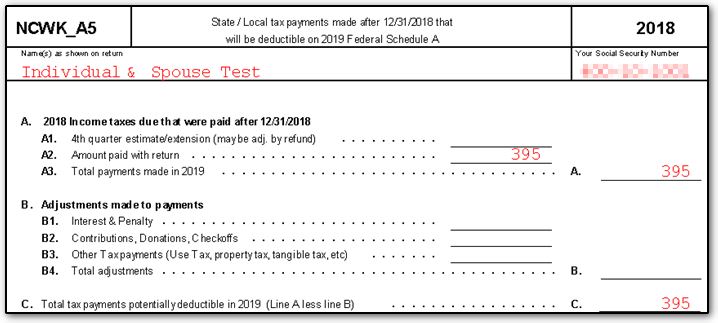

1040 State Taxes On Wks Carry Schedulea

The IRS page Individual Shared Responsibility Provision -- Reporting and Calculating the Payment explains.

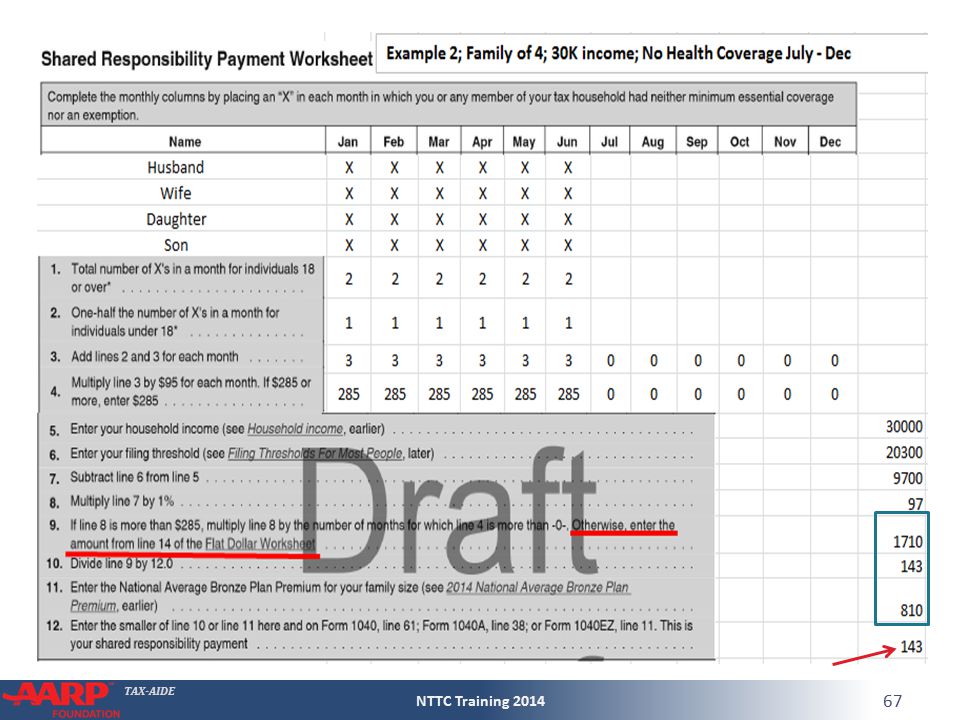

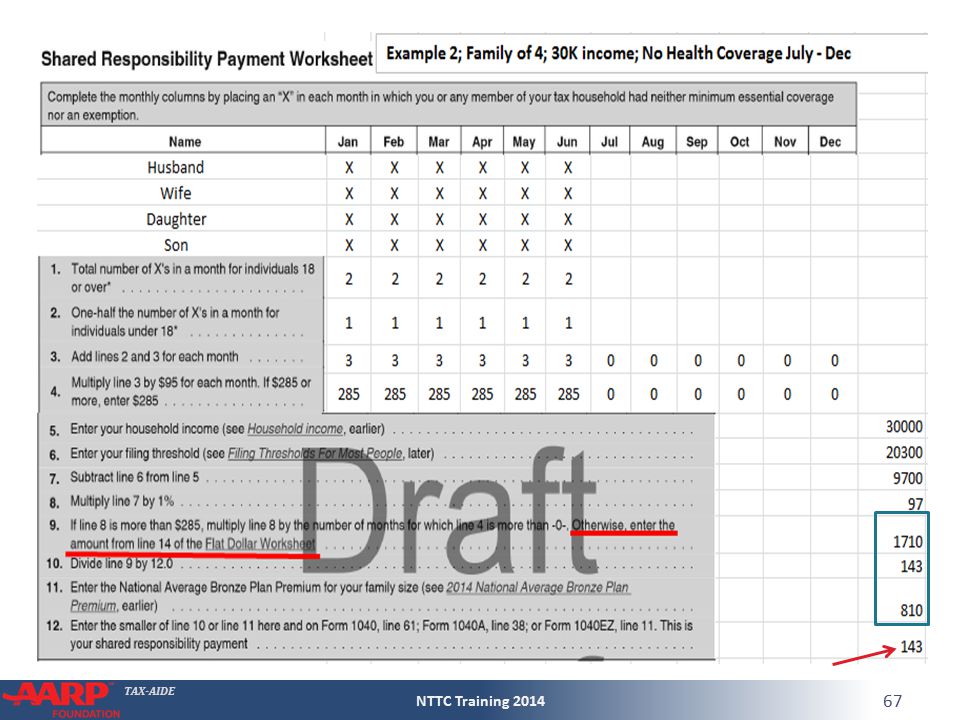

2018 shared responsibility payment worksheet. For each month enter the lesser amount of line 5 or line 10 from the Shared Responsibility Payment Worksheet. Change The new tax law didnt change the ISRP for tax year 2018. That single taxpayer who earned 52000 a year would therefore owe 1000 for the shared responsibility payment because.

For tax year 2018. The Affordable Care Act is. Beginning with the 2019 tax year for which tax returns are filed in early 2020 the Shared Responsibility Payment or penalty for not having minimum essential health coverage no longer applies.

Calculate Your 2018 Obamacare Penalty. See Shared Responsibility Payment later to figure your payment if any. In tax year 2018 the checkbox to indicate full coverage or an available exemption is located on revised Form 1040 page 1.

Report your shared. If you are subject to the Shared Responsibility Payment the payment is the larger of the flat dollar amount or your excess income amount. Remember paying the shared responsibility payment doesnt mean you now have health insurance.

Ad The most comprehensive library of free printable worksheets digital games for kids. Youll still be responsible for all of your medical costs plus the. The individual responsibility payment amount will show on Schedule 4 Other Taxes line 61.

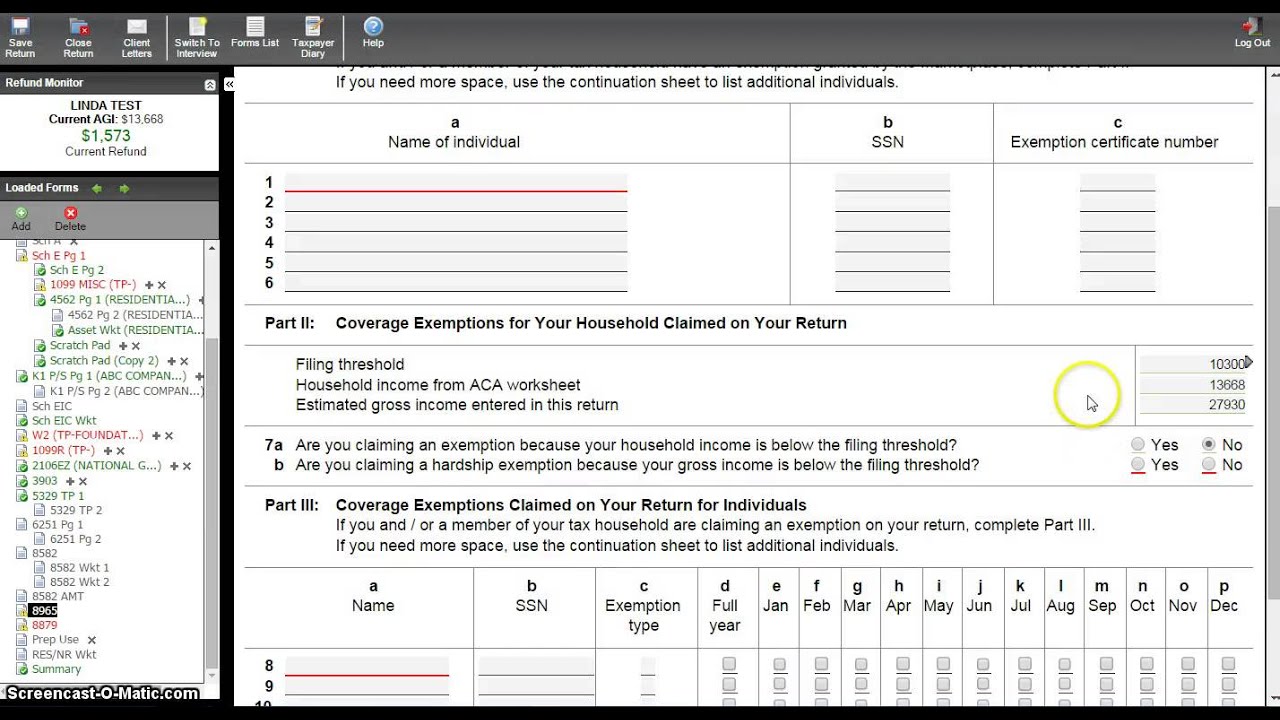

Under the Tax Cuts and Jobs Act the amount of the individual shared responsibility payment is reduced to zero for months beginning after December 31 2018 Beginning in Tax Year 2019 Forms 1040 and 1040-SR will not have the full-year health care coverage or exempt box and Form 8965 Health Coverage Exemptions will no longer be used. The calculated payment amount will flow from the worksheet to Schedule 4 line 61 and to line 14 on page 2 of the new Form 1040. You must make a shared re-sponsibility payment if for any month you or another member of your tax household didnt have health care coverage referred to as minimum essential coverage or a coverage exemption.

285 is the family max flat dollar. The total of all taxes entered on Schedule 4 is then transferred to Line 14 of the 2018 Form 1040. Get thousands of teacher-crafted activities that sync up with the school year.

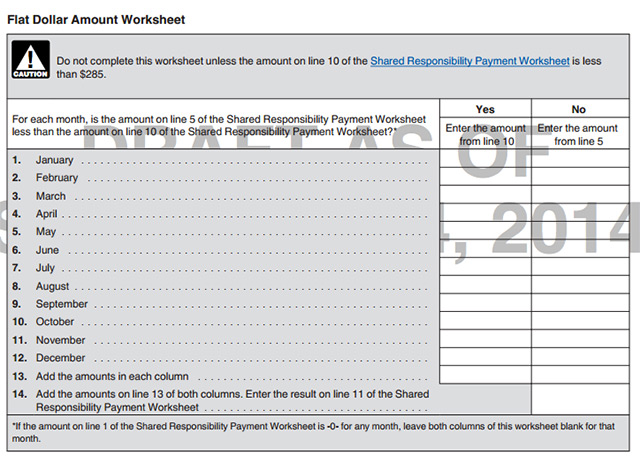

The Shared Responsibility Payment is determined based on your filing threshold and the flat dollar amount for the tax year. On the Flat Dollar Amount Worksheet add up the columns from Line 1-12 on line 13 add those together then write the total in line 14. This is known as the shared responsibility payment.

The amount is derived from the Shared Responsibility Payment Worksheet found on form 8965 instructions and is reported on a 1040 Schedule 4. The penalty will still be calculated on the shared responsibility worksheet. This determines which flat dollar amount you pay per month.

As a result a taxpayer who does not have health coverage in 2019 or later does not need an exemption to avoid the penalty and Affordability Worksheet. For 2015 the full payment is 325 for each adult 16250 for each child up to a maximum of 975 -- or. Use this calculator to estimate your 2018 ACA penalty.

For plan years through 2018 if you can afford health insurance but choose not to buy it you may pay a fee called the individual Shared Responsibility Payment when you file your federal taxes. It is capped by national average premium for qualified health plans that have a bronze level of coverage the national average bronze plan premium. The fee is sometimes called the penalty fine or individual mandate.

It is important to note that this repeal will not take effect until January 1 2019. The national average bronze plan premium is an overall cap limit on the payment. If youre only covered for part of the year it can be prorated to apply only to the months you arent insured or exempt.

The fine if any is enforced as a result of the Shared Responsibility Payment under the individual mandate of the. One of the provisions of the TCJA was the repeal of the individual shared responsibility payment related to the individual shared responsibility more commonly known as the individual mandate under the Affordable Care Act ACA. Note that these line references may change when 2018 forms are finalized.

This is the last ACA-related thing you will fill out since it requires knowing information from other forms first. For 2018 due to the absence of the personal exemption the filing threshold is the same amount as the standard deduction The shared responsibility payment is reported on Line 61 of the new Schedule 4 - Form 1040. Get thousands of teacher-crafted activities that sync up with the school year.

The Affordable Care Acts Individual Mandate has been phased out and 2018 was the final year in which an Obamacare penalty could apply. For 2014 the full payment is 95 for each adult 4750 for each child up to a maximum of 285 -- or 1 of your household income whichever is higher. It was 695 for each adult and 34750 for each child with a family maximum of 2085 in tax years 2016 2017 and 2018.

If you must make a payment you can use the worksheets located in the instructions to IRS Form 8965 Health Coverage Exemptions to figure the shared responsibility payment amount due. The shared responsibility payment is being implemented gradually over a number of years. For 2018 it is 283 per month for each family member up to four and 1415 per month for a family with five or more.

3 14 1 Imf Notice Review Internal Revenue Service

What Is A Shared Responsibility Payment

Solved David And Darlene Jasper Have One Child Sam Who Is 6 Years Old Birthdate July 1 2012

1040 Shared Responsibility Payment Aca

Form 8965 Health Coverage Exemptions And Instructions

Individual Shared Responsibility Payment

Individual Shared Responsibility Payment

What Is A Shared Responsibility Payment

What Is A Shared Responsibility Payment

What Is A Shared Responsibility Payment

What Is A Shared Responsibility Payment

Form 8965 Health Coverage Exemptions And Instructions

Form 1095 A 1095 B 1095 C And Instructions

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

What Is A Shared Responsibility Payment